Cloud-based platform intended for accounting and tax professionals

Apply the power of technology to tax-related tasks

Accomplish more with us

BRAINCAZ is a cloud-based platform intended for accounting and tax professionals. The application allows you to undertake tasks in an efficient and simplified manner.

Optimize your worktime

Reduction of low value time through the automation of tax processes within corporate tax planning and an increase in the degree of quality through the use of computer processes.

More collaborative work

Improved exchanges of information among the various internal stakeholders, particularly concerning the information to be submitted for tax compliance

(T1, T2, T3)

Cloud-based software solution

Quick and detailed access to diverse client data (Shareholders, Investments, Dividends, Compliance, etc.) in a safe and private cloud environment.

Simplified overview

In an easy-to-understand interface, get a complete view over all the operations related to a client file in order to facilitate your work. You have the skills and intelligence, we provide the software to boost your work.

Collaborate in real time with your colleagues

Each member of your team will have its own private and secure access with permissions configured by your management team to follow your daily work in real time and see what’s accomplished by everyone.

Join us in the next tax revolution !

The functionalities of Braincaz

Discover the potential of our software solution for your daily work

PREPARATION OF TAX OPERATIONS

Sequencing of Procedures

The application prepares and organizes the effective sequencing of tax procedures

(Rollover, Exchange, Redemption, Sale, Dividends, Almagation, etc.).

Follow-up of files in progress

The list of files in progress facilitates task planning. In addition, filters allow a better follow-up per user.

Shareholder Updates

Lists of shareholders and tax attributes of the shares, updated after each tax procedure has been performed.

Diagnostics

Several diagnostics included in the framework of the performance of tax procedures minimize the risk of error.

Tax memorandum (or procedures report)

Automated creation of tax memorandums or procedure summaries.

TAX COMPLIANCE MANAGEMENT

Tax Elections

Automated creation of tax election forms related to rollover procedures.

T-CAZ Tax Forms

Automatic determination of the compliance effects (T1, T2, T3) of tax procedures and automatic classification of the client file according to the type of form processed.

Client filter to manage compliance

Client lists can be organized by fiscal year-end date, entity or persons responsible to facilitate compliance tracking.

Dividend register

After processing your tax procedures, a journal of the dividends paid can be viewed for each corporation.

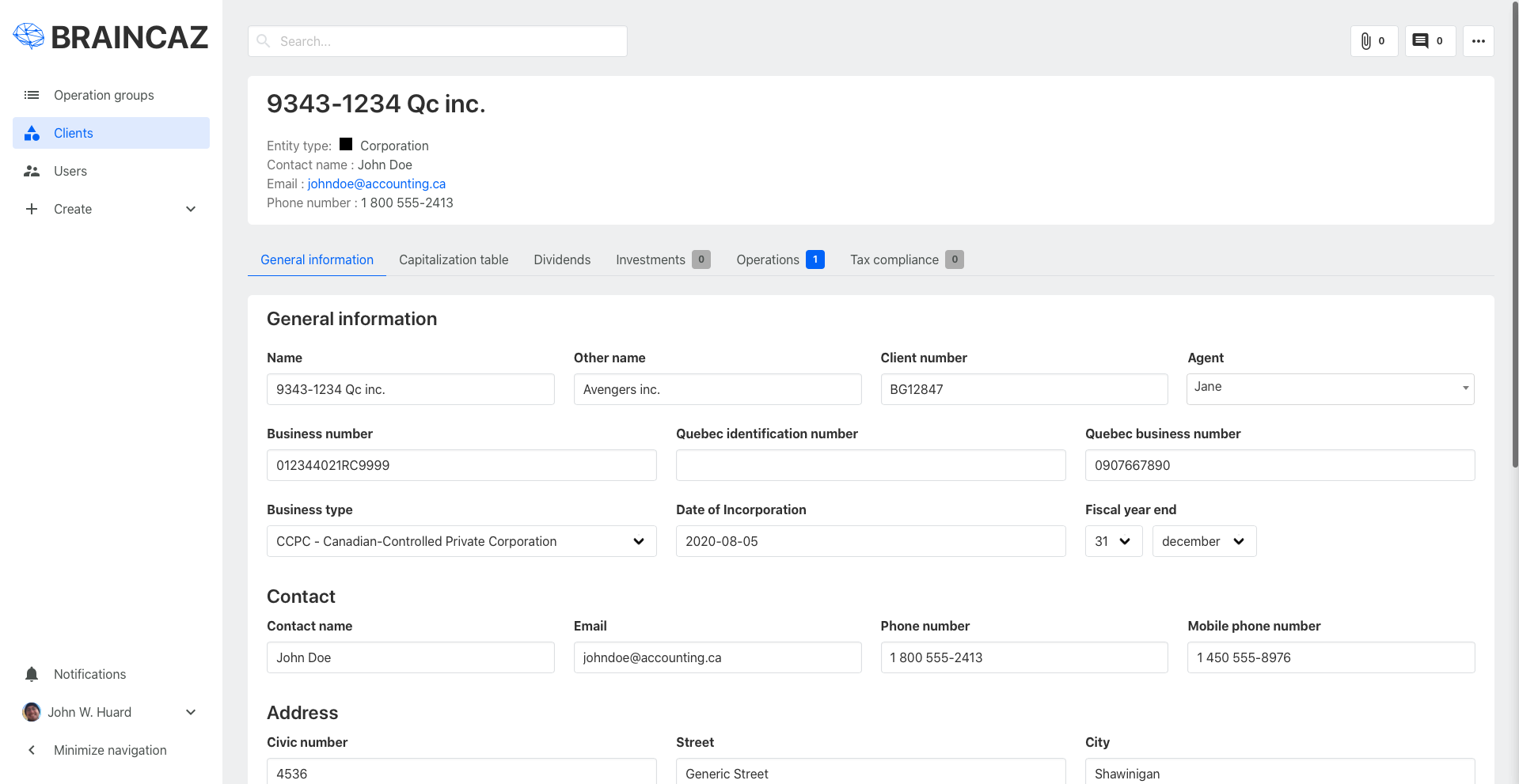

MAINTAINING CLIENT FILES

Permanent file 2.0

Permanent information concerning clients (contact details, notes, important documents, list of shareholders, list of investments, dividends, compliance) can be accessed at any time.

Quick search bar

Quick use of the search bar to access a client file or find a client number.

Investment follow-up

Possibility for each entity to consult the list of investments held in the companies identified in the lists of shareholders can be accessed at any time by each entity.

Security

The application is hosted on a secure server which has successfully passed a security audit performed by a leading organization in the industry.

File annotation

Important notes can be attached to the pages of the permanent files or to the working pages of the companies involved in the different operations.

Gain time to delight your clients by automating low-value tasks

With the use of Braincaz, reduce your margin of error, accelerate and ease the onboarding of new employees and gain even more efficiency for you and your clients.

"BRAINCAZ is an easy-to-use and powerful software adapted to the daily practice of accountants and fiscalists."

Ready to use Braincaz ?

About BRAINCAZ

BRAINCAZ’s mission is to provide added value to accounting firms in the delivery of their services through the use of technology, tax laws and the interconnectedness of information.